ato are raffle tickets tax deductible

Are charity raffle tickets tax deductible. This is because the purchase of raffle tickets is not a donation ie.

Tax Deductible Donations Reduce Your Income Tax The Smith Family

It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year.

. For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution. Are Surf Life Saving Lottery Tickets Tax Deductible. Do I get a receipt for my raffle ticket purchase.

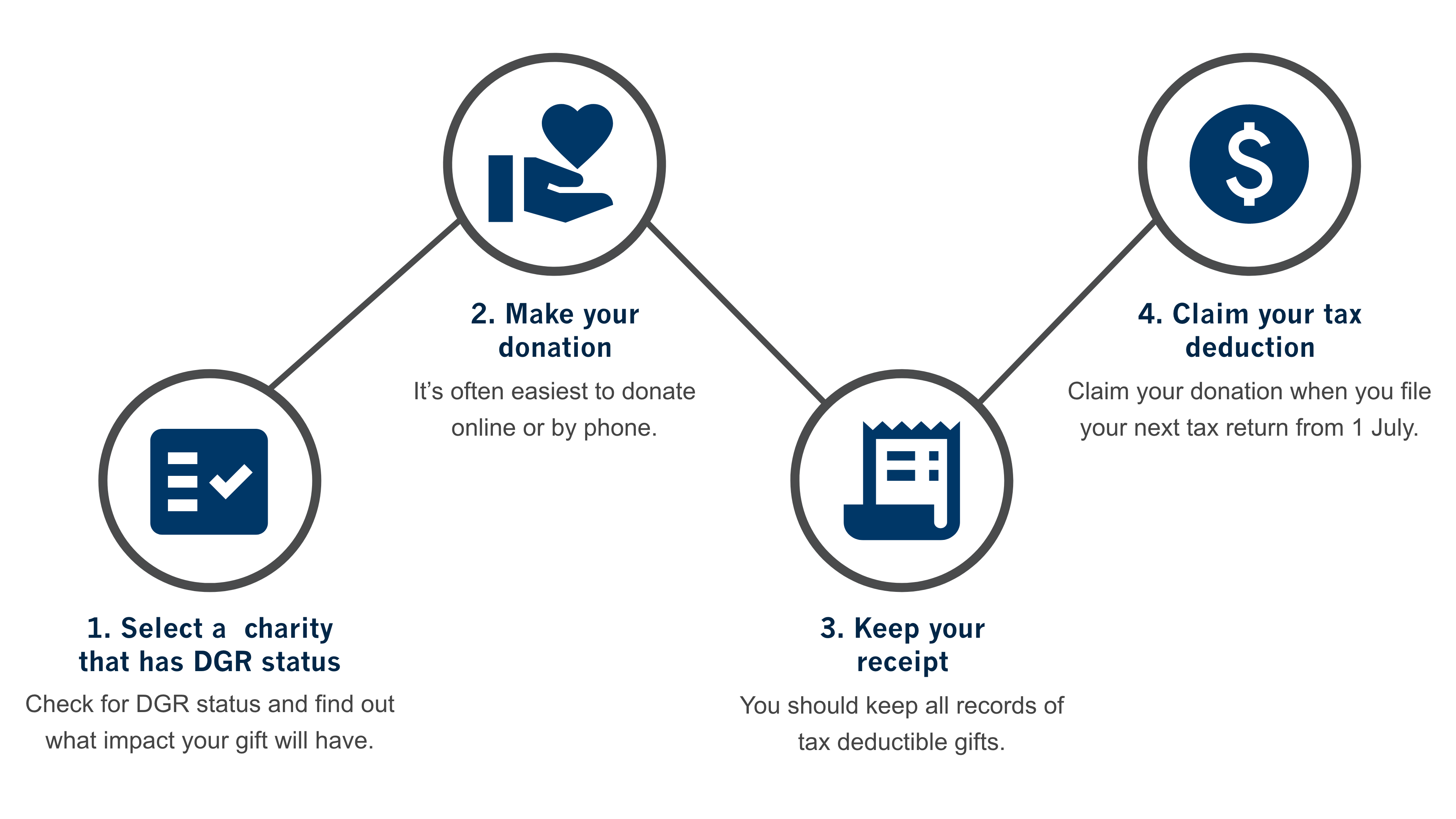

If the ticket purchaser pays an amount of money that exceeds the fair market value of what is received then this excess is what can qualify as a tax deductible charitable contribution. As such a raffle generally refers to a method for the distribution of prizes among persons who have paid for a chance to win such prizes usually determined by the numbers or symbols on tickets drawn. For a donation to be tax deductible the organisation has to be endorsed by the Australian Tax Office ATO as a Deductible Gift Recipient DGR.

In general a raffle is considered a form of lottery. If you donate property to be used as the raffle prize itself its value may be deductible as a charitable contribution. When you purchase a book of raffle tickets from a charity you are receiving something of material value in the exchange.

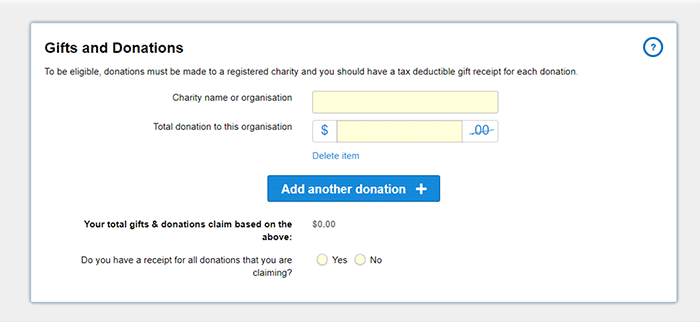

Any donation that meets this criteria is considered a tax deductible donation which means you can deduct the amount of your gift from your taxable income on your tax return. For more information about event-related criteria visit the ATOs website here. The sale of tickets in a raffle and the acceptance of a persons participation in a game of bingo by a registered charity gift deductible entity or government school are GST-free provided they do not contravene state or territory law.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Since donors are not given no strings attached donations ATO considers donations to be gifts so any return you may receive is yours as well. Such as a raffle ticket.

Can I donate my winnings back to the organization. Are my creditdebit card transactions secure. Does the winner of a raffle have taxable income.

If I win a raffle do I have to pay any taxes. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations.

How will my purchase appear on my credit cardbank statement. The fair market value of the prize will be treated as ordinary income to the winner for federal and state income tax purposes. Tickets for a raffle can only be refunded if they benefit a reputable charity regardless of whether they are purchased.

This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts. Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. There is the chance of winning a prize.

Is my raffle ticket purchase tax deductible. So it cannot be claimed as a tax-deductible donation. Unfortunately fund-raising tickets are not deductible.

How do I collect my winnings if I win a raffle. If the ticket price is over 10 the fair market value of the prize should be provided on the raffle ticket or in a disclosure received when purchasing the ticket.

How To Claim A Tax Deduction On Christmas Gifts And Donations

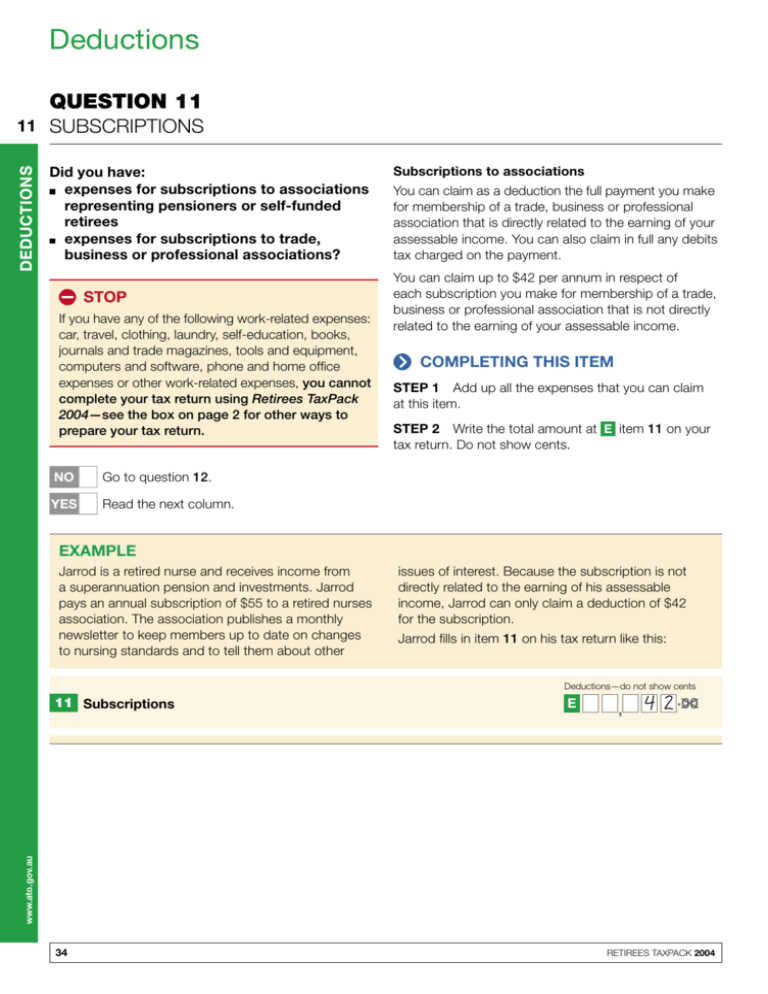

Deductions Australian Taxation Office

Tax Deductions You Can Claim This Financial Year Clayton Accountants L Tax Accountants Clayton L Lotus Smart

Ato Are Raffle Tickets Tax Deductible Iae News Site

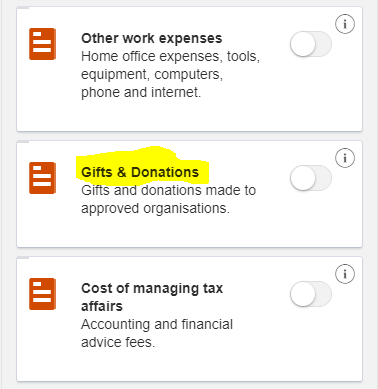

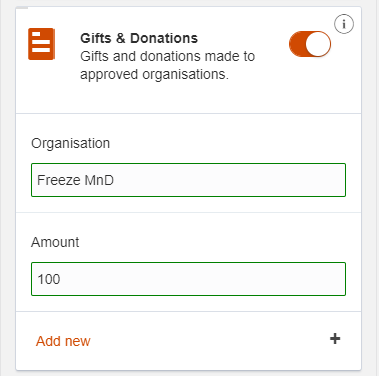

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre

Question Are Opportunity Drawing Tickets Tax Deductible Seniorcare2share

Ato Are Raffle Tickets Tax Deductible Iae News Site

How To Claim Tax Deductible Donations On Your Tax Return

Taxpack 2011 Supplement Australian Taxation Office

How To Claim Tax Deductible Donations On Your Tax Return

Ato Are Raffle Tickets Tax Deductible Iae News Site

Short Tax Return Instructions 2013 Australian Taxation Office

Ato Warns Of Common Tax Deduction 2 In 3 Get Wrong

How To Claim Tax Deductible Donations On Your Tax Return

Claiming Gifts And Donations On The Airtax Tax Return Airtax Help Centre